Introduction

The relationship between property rights and economic growth has long been a central theme in economics, political science, and development studies. Secure property rights are often cited as a cornerstone of prosperity, creating incentives for investment, innovation, and efficient resource allocation. Conversely, weak or uncertain property rights are frequently associated with stagnation, corruption, and underdevelopment. This article explores the intricate link between property rights and economic growth, drawing on comparative insights from different historical periods, regions, and institutional frameworks.

The Role of Property Rights in Economic Theory

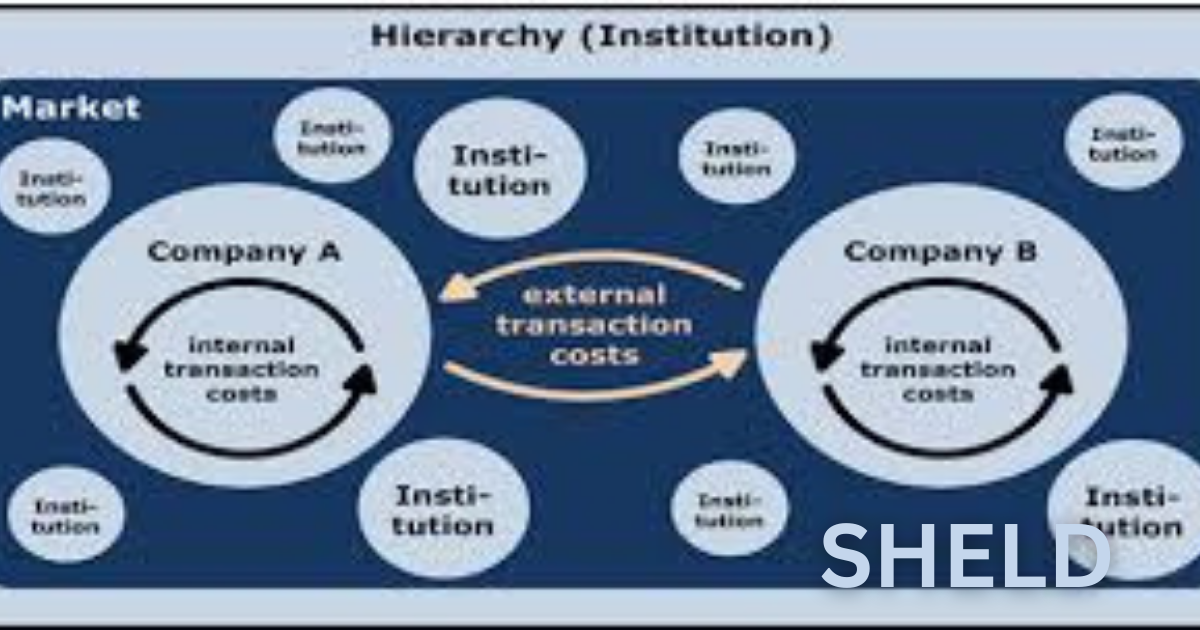

In economic theory, property rights refer to the legal authority to use, transfer, and benefit from resources or assets. They serve several key functions:

- Incentives for investment: When individuals and firms know they can reap the benefits of their efforts, they are more likely to invest in capital, innovation, and productivity improvements.

- Reduction of uncertainty: Secure property rights reduce risks associated with expropriation or arbitrary seizure, encouraging long-term planning.

- Efficient resource allocation: Clearly defined ownership facilitates voluntary exchange, enabling markets to allocate resources to their most valued uses.

- Internalization of externalities: When owners bear both the costs and benefits of resource use, they are incentivized to act efficiently.

The absence of secure property rights often leads to the “tragedy of the commons,” corruption, and informal markets that hinder growth.

Historical Evidence

- England’s Enclosure Movement

During the 16th to 18th centuries, England transformed its agricultural sector through the enclosure of common lands. By granting private property rights, landowners had greater incentives to invest in productivity-enhancing innovations such as crop rotation and mechanization. These developments played a critical role in fueling the Agricultural Revolution and, subsequently, the Industrial Revolution. - Colonial Institutions and Divergent Development

Daron Acemoglu, Simon Johnson, and James Robinson’s influential work highlights how colonial powers established different types of property rights institutions depending on local conditions. In settler colonies such as the United States, Canada, and Australia, secure property rights encouraged investment and growth. In contrast, extractive institutions in regions like sub-Saharan Africa and Latin America often restricted property rights to elites, leading to inequality and slower economic development. - Post-Socialist Transitions

The collapse of centrally planned economies in Eastern Europe and the former Soviet Union illustrates how transitions in property rights affect growth. Countries that implemented clear and enforceable private property rights (e.g., Poland, Czech Republic) generally experienced more successful economic transformations compared to those with weak or corrupt privatization processes (e.g., Russia, Ukraine).

Comparative Regional Perspectives

- East Asia

East Asian economies, particularly South Korea, Taiwan, and later China, demonstrate how property rights reforms contribute to growth. In China, the Household Responsibility System of the late 1970s granted farmers more secure rights to land use, dramatically increasing agricultural productivity. Subsequent reforms extended property rights to urban enterprises, fueling rapid industrialization. - Sub-Saharan Africa

Many African countries face challenges with ambiguous property rights, particularly regarding land ownership. Customary land tenure systems often clash with formal legal frameworks, creating uncertainty that discourages investment. Efforts to formalize land rights have shown promise but face implementation barriers such as corruption, administrative inefficiency, and political resistance. - Latin America

In several Latin American countries, property rights remain concentrated in the hands of elites, limiting broad-based economic growth. Land inequality and weak enforcement mechanisms create barriers for small farmers and entrepreneurs. However, land titling programs in countries such as Peru have empowered informal settlers by granting them legal ownership, enabling access to credit and improving livelihoods.

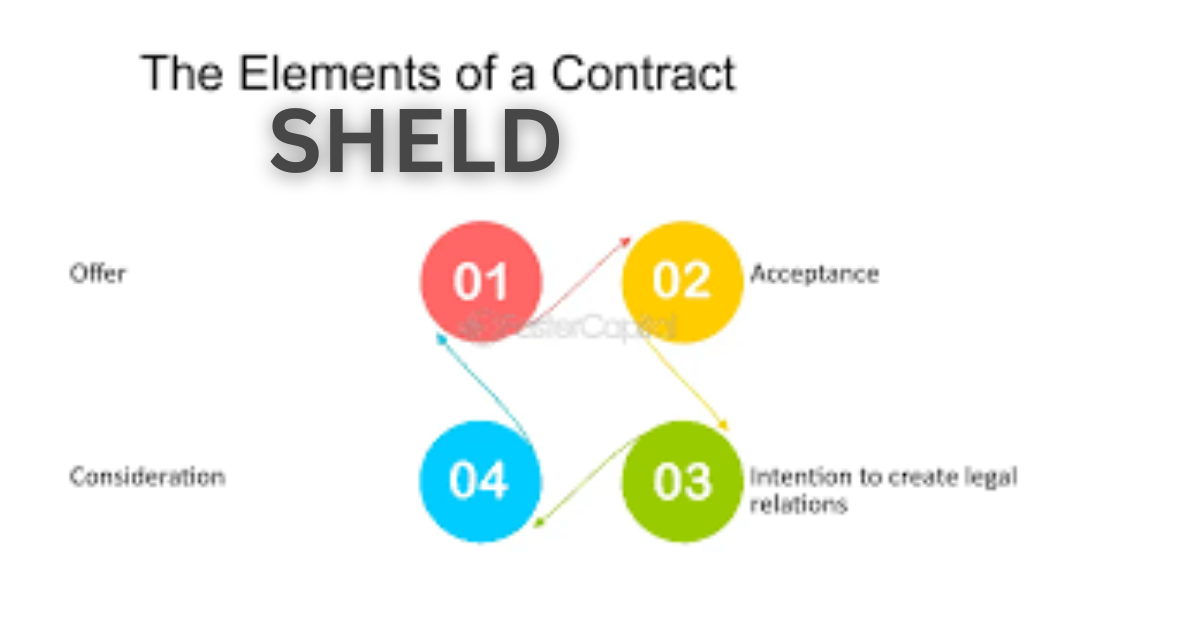

Property Rights Beyond Land

Property rights are not limited to physical assets. In modern economies, intellectual property (IP) rights play an increasingly critical role in fostering innovation. Strong IP protection provides inventors and creators with incentives to develop new technologies, pharmaceuticals, and cultural products. However, excessive protection can also stifle competition and limit access, raising questions about the optimal balance between innovation and diffusion.

Similarly, corporate governance structures—essentially the property rights of shareholders and stakeholders—determine how firms are managed and how profits are distributed. Weak protections for minority shareholders, for example, often deter foreign investment and limit capital market development.

Challenges and Criticisms

- Overemphasis on Formalization

While formal property rights are essential, scholars such as Hernando de Soto emphasize that informal arrangements can also support economic activity. Overemphasis on legal formalization without addressing broader institutional weaknesses may fail to deliver expected growth. - Equity vs. Efficiency

Secure property rights may promote efficiency, but they can also exacerbate inequality if rights are concentrated in the hands of elites. Policies must therefore balance incentives for growth with social justice considerations. - Globalization and Intellectual Property

In a globalized economy, the international enforcement of IP rights creates tensions between developed and developing nations. For example, strict patent protections for pharmaceuticals can limit access to essential medicines in poorer countries.

Policy Implications

The comparative evidence suggests several policy lessons:

- Strengthening legal institutions: Effective courts and enforcement mechanisms are essential for protecting property rights.

- Balancing inclusivity and efficiency: Policies should ensure that property rights extend broadly, preventing excessive concentration of wealth and opportunity.

- Context-sensitive reforms: Successful property rights reforms must account for local cultural, political, and institutional contexts rather than imposing one-size-fits-all solutions.

- Encouraging innovation while maintaining access: Intellectual property regimes should incentivize creativity without undermining affordability or competition.

Conclusion

The comparative study of property rights and economic growth reveals a consistent pattern: secure, inclusive, and well-enforced property rights are strongly correlated with prosperity, while weak or exclusive rights hinder development. From England’s Agricultural Revolution to China’s reform era and beyond, property rights have shaped the trajectory of economies across the globe. Yet the challenge lies in designing property rights systems that not only promote efficiency and growth but also ensure equity, sustainability, and resilience in an increasingly interconnected world.